Research

Swarm is mentioned in a number of reports produced by independent research teams around the world. Below is a selection of reports on tokenization of real-world assets.

SEPTEMBER 2023

EY explores the evolution of distribution channels and evaluates the benefits of asset tokenization for institutions.

JULY 2023

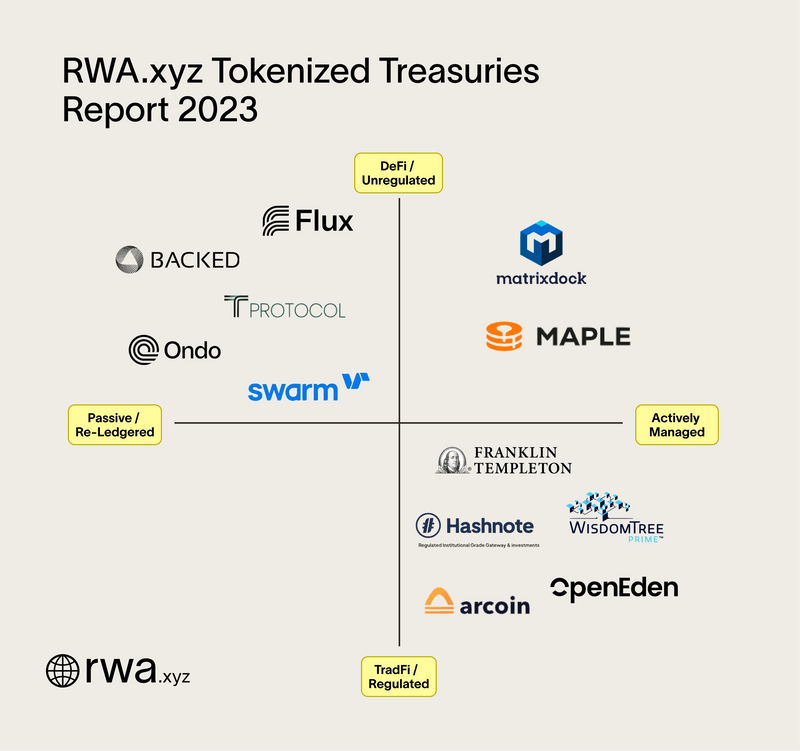

Binance Research’s second report on tokenization explores the US$600M investors are effectively lending over to the U.S. government today via the tokenized treasury market.

JULY 2023

From $100B+ asset managers to young startups, tokenized US Treasuries are exploding in popularity. This 50+ page report dives into the details of what differentiates them.

APRIL 2023

EY explores institutional attitudes towards tokenization, the benefits and which tokenized assets they are most interested in investing in.

MARCH 2023

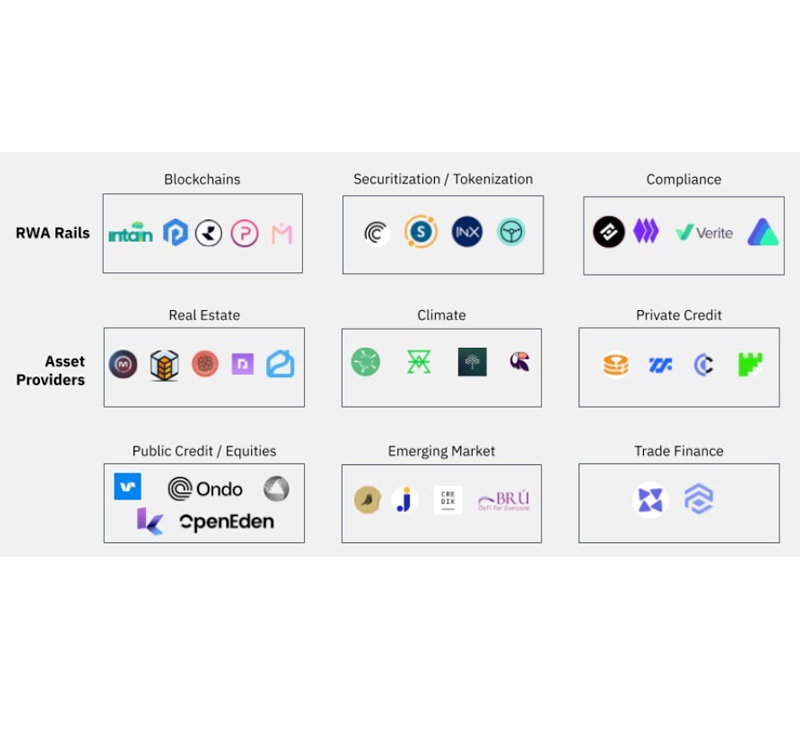

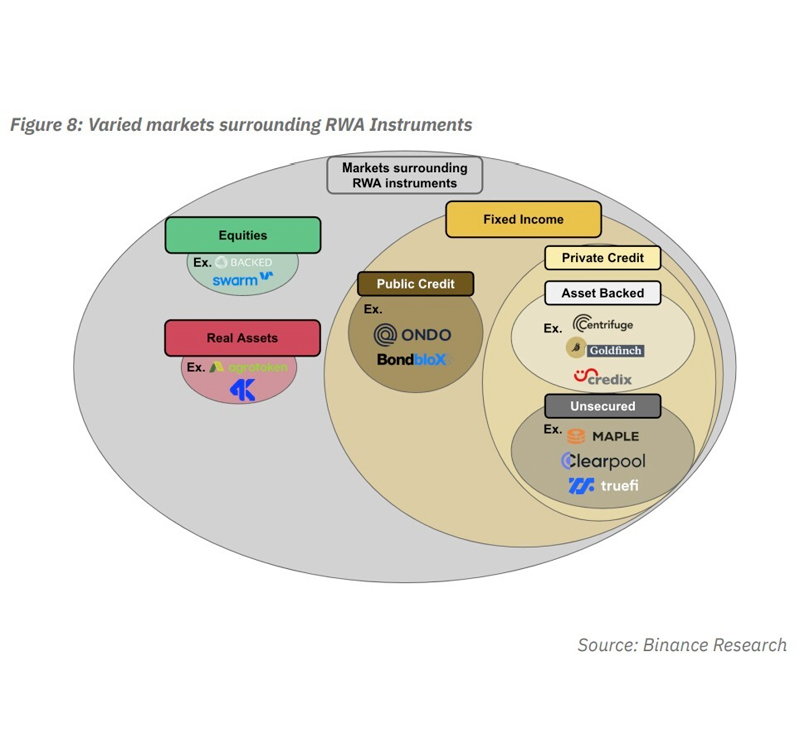

Binance Research’s first deep dive into tokenization of real-world assets. The report looks at how this application of blockchain technology could bridge DeFi with TradFi.

Q1 2023

This report looks at institutional investment into tokenized products beyond government bonds, and into publicly-traded products through money market funds and into private investments through developments in private credit.